How to Set Up an Emergency Fund: Building a Financial Safety Net from Scratch

In our journey through life, the unexpected is always lurking. From car accidents to job losses and sudden medical expenses, life throws challenges at us when we least expect it. An emergency fund is one of the most crucial financial tools to help us cope with these challenges. Setting up an emergency fund to truly provide security is a critical task. This article will delve into how to reasonably set up an emergency fund to help you avoid falling into financial hardship during unexpected events.

1. The Importance of an Emergency Fund: Why Everyone Needs One

An emergency fund is more than just a regular savings account; it is one of the most fundamental financial safety nets. The primary purpose of an emergency fund is to ensure that when an unexpected event occurs, financial problems do not impact your quality of life or mental well-being. For example, if you suddenly become ill and can’t work, or if you need to relocate due to a natural disaster, having enough emergency savings can alleviate some of the pressure.

Typically, people without an emergency fund are more likely to fall into financial trouble during unexpected events. For instance, after losing a job, many people may rush into finding a new job but make poor choices due to a lack of savings, sometimes relying too heavily on credit cards or loans. Those who have an emergency fund, however, can remain calm in difficult times, make better decisions, and avoid taking short-term actions driven by financial stress.

2. How to Calculate the Amount Needed for an Emergency Fund

The first step in setting up an emergency fund is calculating the required amount. The amount needed varies based on lifestyle, family structure, job type, and personal expenses. A general recommendation is to have at least three to six months’ worth of living expenses saved up as an emergency fund. This is a rough guideline, but you can adjust it based on your specific situation.

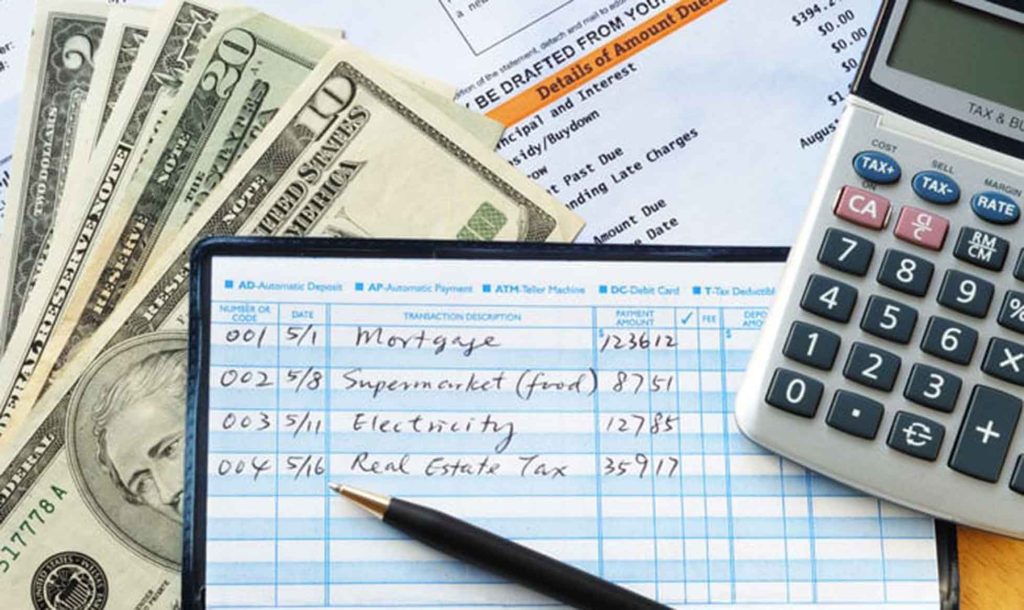

Calculating Monthly Expenses

Before setting up an emergency fund, you need to figure out your monthly fixed and variable expenses. Fixed expenses include rent, loans, transportation, insurance, and other regular monthly payments; variable expenses include food, entertainment, shopping, dining out, and other non-regular costs. You can track your monthly bills and spending to get a better idea of your typical living costs.

For example, suppose your fixed expenses amount to $2,000 per month and variable expenses are $1,500. Your total monthly expenses would be $3,500. Based on this, if you plan to establish an emergency fund for three months, you would need at least $3,500 * 3 = $10,500. If you want to prepare for six months’ worth of expenses, the amount required would be $3,500 * 6 = $21,000.

Adjusting for Lifestyle and Spending

When calculating the amount for your emergency fund, you also need to consider your lifestyle. Do you have large debts to repay? Do you have children or other dependents? These factors will influence the amount of emergency savings you need. If your income is stable and your lifestyle is relatively simple, you might opt for a lower emergency fund target. However, if you have a family or higher living expenses, you may need to save more.

3. Choosing the Right Storage Tools for Your Emergency Fund

Once you’ve determined the amount needed for your emergency fund, the next step is figuring out where to store this money. Emergency funds differ from long-term savings in that they require a few specific characteristics: high liquidity, low risk, and some interest income.

Choosing Accounts with Strong Liquidity

One of the most important characteristics of an emergency fund is liquidity. Your emergency fund should be kept in an account that you can access quickly if needed. Many people choose to keep their emergency funds in a checking account or a high-yield savings account. While the interest earned may be low, these accounts offer the advantage of easy access to funds in case of emergency.

Alternatively, some people choose to invest their emergency fund in money market funds or short-term deposits. These accounts generally offer better liquidity and relatively higher returns compared to standard savings accounts. Choose the most suitable account based on your needs and risk tolerance.

Ensuring Fund Security

An emergency fund should be low-risk, which means you should not invest it in high-risk assets like stocks or mutual funds. After all, the purpose of an emergency fund is to deal with unexpected situations, not to be affected by market fluctuations. Therefore, it is more appropriate to choose low-risk financial products like bank deposits or government bonds to store your emergency funds.

Considering Interest Rate Differences

Choosing a high-yield storage tool is also an important consideration. While the primary purpose of an emergency fund is liquidity and security, there’s no harm in earning a bit more interest. Currently, some online banks and internet financial platforms offer higher interest rates for savings accounts, making them a good option. Be sure to compare interest rates from different banks and financial institutions to find the best deal.

4. How to Build Your Emergency Fund Step by Step

Once you’ve determined the amount for your emergency fund and selected the appropriate storage tools, the next step is how to gradually build up this fund. Most people won’t be able to deposit a large sum of money into their emergency fund all at once, so a well-organized savings plan is key.

Setting a Savings Goal

To prevent the process of building your emergency fund from feeling too long or monotonous, setting a clear savings goal is very important. You can break down your target into monthly contributions and set a reasonable timeline. For example, if your goal is to save $20,000 and you want to achieve it within a year, you would need to save about $1,667 per month.

Automating Savings

Many people find saving to be a tedious task and often abandon it when they face financial pressure at the end of the month. However, automating savings can effectively avoid this problem. By setting up an automatic transfer from your primary account to your emergency fund account each month, you can ensure that you are consistently contributing to your fund without worrying about forgetting or overspending.

For instance, you could set up an automatic transfer of $1,000 from your salary account to your emergency fund account every month. Although the monthly amount may seem small, over time, this will accumulate and eventually reach your goal.

Adjusting Your Savings Plan Flexibly

Life is unpredictable, and certain events or unforeseen expenses may affect your monthly savings plan. For instance, you may face unexpected medical costs or need to cover extra expenses for your family. In such cases, do not panic. Instead, adjust your savings plan as needed, whether by reducing your savings for a particular month or extending your savings period. The key is to avoid stopping your savings altogether.

5. Integrating Your Emergency Fund with Other Financial Plans

While the emergency fund is intended to handle short-term unforeseen events, it is closely connected to other aspects of your financial planning. How to balance your emergency fund with other financial goals is an important skill to master.

Combining with Long-Term Savings

An emergency fund is primarily for dealing with short-term unexpected events, while long-term savings are meant for goals like purchasing a home, funding education, or preparing for retirement. Therefore, while setting up an emergency fund, you also need to have a long-term savings plan. In the short term, once your emergency fund is in place, you should focus on allocating more of your funds toward your long-term goals.

Investment and Risk Management

An emergency fund and investments are two completely different financial concepts. Investments are a means of growing wealth but come with higher risks. Although long-term investments can bring substantial returns, an emergency fund must prioritize low-risk and high-liquidity features. Therefore, when planning your investments, make sure your emergency fund is already established, and that its liquidity and security are not compromised.

Debt Management and Financial Health

If you have significant debts, it’s important to consider managing them while building your emergency fund. High-interest debts, like credit card debt, can quickly eat away at your finances. Thus, when accumulating your emergency fund, it’s also crucial to reduce high-interest debt as much as possible. This will ensure that you are building a solid financial foundation while preparing for emergencies.