Recommended Financial Tracking Apps: Efficiently Manage Your Personal Finances and Boost Wealth Growth

With the development of financial technology, more and more people are focusing on how to better manage their personal finances. Financial management is not only an essential task in daily life but also directly impacts personal financial freedom and wealth growth. To help people better track their finances, manage budgets, control spending, and invest wisely, a variety of financial tracking apps have emerged. These apps provide convenient tools and features that enable users to easily record expenses, check account balances, generate reports, and even formulate investment strategies to make more informed financial decisions.

This article will introduce some outstanding financial tracking apps to help you choose the right tools and enhance your personal finance management skills. Each app has its unique features and advantages, whether it’s for daily expense tracking, budgeting, or asset allocation, all of which can provide substantial help. Below, we will analyze several powerful financial management tools based on different needs.

1. Mint: The Expert in Intelligent Budgeting and Financial Management

Mint is one of the most popular financial tracking apps, offering robust budgeting management and financial tracking features. By linking your bank accounts, credit cards, and other financial accounts, Mint automatically tracks income and expenses, generating detailed reports. Its automatic categorization feature is highly intelligent, recognizing each of your expenditures and categorizing them into food, entertainment, transportation, etc., making daily financial management effortless.

Powerful Budgeting Management Features

Mint’s budgeting management function is highly robust. You can set your monthly expenditure budget, and Mint will help you establish a reasonable budget based on your income and historical spending. If you exceed your budget in a particular category, Mint will send you an alert, helping you adjust your spending plan in time to avoid overspending.

Automated Financial Reports and Alerts

Another great feature of Mint is its ability to automatically generate financial reports. By analyzing your accounts and spending records, Mint periodically generates detailed financial reports that help you understand your financial situation. Each month’s report includes income, expenses, savings, debt, and other aspects of data, allowing you to gain a comprehensive understanding of your financial health. Additionally, Mint provides personalized recommendations based on your spending habits and financial goals, helping you plan for the future.

Security and Privacy Protection

Mint uses bank-level encryption technology to ensure the safety of your financial information. It also supports two-factor authentication to enhance account security. This allows you to safely connect various financial accounts to Mint without worrying about data leaks or privacy issues.

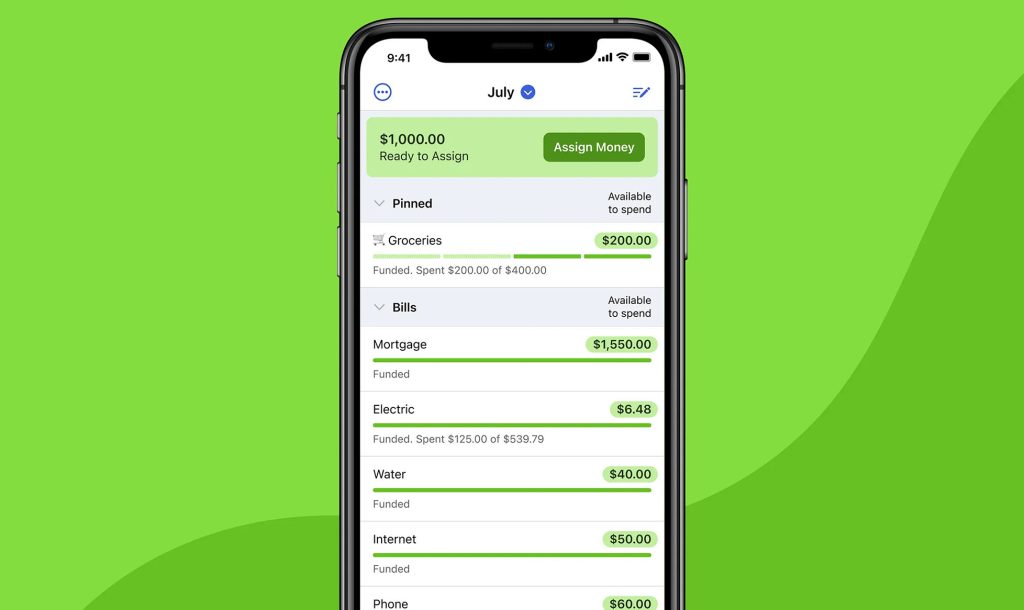

2. YNAB (You Need A Budget): The Best Companion for Budgeting and Financial Planning

YNAB is a financial tracking app focused on budgeting management. It helps users take control of their personal finances by following four unique principles. YNAB not only helps you manage daily expenses but also prepares you for future financial goals. This app is ideal for those who want to achieve precise control over their monthly budgets.

Forward-Looking Budgeting Planning

YNAB’s greatest highlight is its “forward-looking planning” feature. It encourages users to allocate every penny in advance for each spending item rather than waiting until the end of the month to summarize and analyze expenses. This approach helps users control their budget and avoid overspending when the month comes to an end.

Account Linking and Real-Time Updates

YNAB can link with multiple bank accounts and credit card accounts to automatically update each income and expenditure. Whenever you make a purchase, YNAB immediately records the expense and updates your budget balance, ensuring that you always stay on top of your financial situation. The real-time update feature enables you to make better adjustments and decisions, avoiding unnecessary financial difficulties.

Educational Resources and Community Support

YNAB is more than just an app—it also provides extensive educational resources and community support. Whether you are a financial beginner or an experienced user, YNAB’s online tutorials, webinars, and user community can offer valuable advice and assistance. By learning YNAB’s budgeting principles, you can better understand the core principles of financial management and work towards financial freedom.

3. PocketGuard: A Simple and Intuitive Financial Tracking Tool

If you don’t like complicated financial management tools, PocketGuard might be the ideal choice for you. This app is designed to be simple and intuitive, helping users efficiently track daily expenses while setting a reasonable budget.

Easy to Use and Quick to Get Started

PocketGuard has a clean and intuitive interface, suitable for users who are not interested in complex features. You just need to link your bank accounts, credit cards, and investment accounts to the app, and it will automatically categorize and track your expenses. With no cumbersome setup or operation required, PocketGuard helps you quickly get a clear understanding of your financial situation, making it ideal for busy users who are short on time.

Automatic Calculation of “Disposable Income”

PocketGuard has a very useful feature—the automatic calculation of disposable income. By tracking your fixed income and expenses, it accurately calculates how much disposable income you have each month. This feature can help you better understand your financial situation, avoid overspending, and ensure that you always have enough funds to cover daily expenses.

Financial Goals and Savings Plans

PocketGuard also allows users to set financial goals and savings plans. Whether you’re saving for a house, a trip, or an emergency fund, PocketGuard can help you define your goals and provide savings advice. This allows you to easily track and achieve your financial goals amid your busy daily life.

4. Personal Capital: Asset Management and Investment Tracking Expert

Personal Capital is not just a financial tracking app; it is also an asset management tool, especially suitable for users with investment needs. If you’re looking to manage daily expenses, track investment portfolios, and understand your asset-liability situation, Personal Capital will be an excellent choice.

Clear Overview of Assets and Liabilities

Personal Capital offers a comprehensive asset-liability statement that helps users clearly understand their assets and liabilities. By linking your bank accounts, credit cards, investment accounts, and other financial data, you can view your total assets, net worth, and the performance of various investments in real-time. This allows you to have a full view of your financial situation and make more rational financial decisions.

Investment Portfolio Tracking and Analysis

In addition to daily financial management, Personal Capital provides powerful investment portfolio tracking features. You can add stocks, bonds, funds, and other investment products to the app and track their performance and returns in real-time. Personal Capital’s investment analysis feature is very strong, helping you assess investment risks, optimize your portfolio, and ultimately achieve wealth growth.

Financial Planning and Retirement Planning

Personal Capital also offers retirement planning features to help users create long-term financial plans. By entering personal retirement goals, expected retirement age, monthly savings amounts, and other information, the app provides a quantitative financial plan, helping you understand how far you are from achieving your retirement goals. In addition, Personal Capital helps you calculate the funds needed for retirement, ensuring that you are well-prepared for the future.

5. Expensify: A Professional Business Expense Management Tool

For users who travel frequently or have business finance management needs, Expensify is a highly useful app. It specializes in business expense management and helps users efficiently track and reimburse various travel expenses.

Automatic Scanning and Intelligent Categorization

Expensify’s biggest feature is its intelligent scanning function. You only need to take a picture of a receipt, and Expensify will automatically extract the receipt information and categorize it. Whether it’s dining, transportation, or accommodation, Expensify can accurately identify and classify the expenses, reducing the time and effort required for manual input.

Expense Reimbursement and Team Collaboration

Expensify not only supports individual users but also works for teams and companies. Through this app, team members can share financial information, submit expense reimbursements, and ensure transparency and efficiency in the financial process. Administrators can easily approve reimbursement requests and generate detailed financial reports. This is very helpful for managing company finances, reducing manual operations, and improving reimbursement efficiency.

Credit Card and Bank Account Linking

Expensify also supports linking credit cards and bank accounts to the app, automatically importing transaction records. This means users don’t need to manually enter every expense, reducing cumbersome operations and improving the efficiency of financial management.

Whether it’s for personal finance management, budgeting, investment portfolio tracking, or business expense handling, the financial tracking apps listed above offer practical features. They help users gain a clear understanding of their financial situation, manage budgets effectively, make timely adjustments, and achieve better financial goals. If you’re looking for an efficient and intelligent financial tracking tool, you can choose the most suitable app based on your needs, helping you achieve financial freedom and wealth growth.