Recommended Financial Tracking Apps: Make Your Financial Management Easier and More Efficient

In today’s society, financial management is no longer just a traditional, cumbersome process that requires manual bookkeeping. With the advancement of technology, an increasing number of financial tracking apps have emerged, providing users with efficient and precise tools for managing their finances. These apps not only help users track daily expenses and plan budgets, but they also offer data analysis and report generation functions, making it easier to understand their financial situation. This article will introduce several popular and practical financial tracking apps on the market, helping you find the most suitable tool for your financial management needs.

1. Mint: A Comprehensive Personal Finance Management Assistant

If you’re looking for an all-in-one financial management tool, Mint may be your best choice. This app has gained a significant share in the US market and is loved by users. Mint allows you to integrate all your bank accounts, credit cards, investment accounts, and more into one platform, enabling “one-stop” financial tracking.

Features

- Account Integration: Mint supports connecting various bank accounts, credit cards, loans, and other financial instruments, consolidating all your account information in one place.

- Automatic Expense Categorization: The app automatically categorizes your expenses into categories such as dining, shopping, entertainment, etc., helping you understand where most of your money is going.

- Budget Management: Users can set budgets based on their income and spending, and Mint will alert you if you’re exceeding your budget, helping you plan your spending wisely.

- Bill Reminders: Mint reminds you in advance of upcoming bills, helping you avoid missed payments.

- Financial Reports: Mint generates clear financial reports through data visualization, allowing you to stay on top of your financial situation at any time.

User Experience

Mint’s interface is simple and clear, making it easy to use. Whether you’re new to financial management or have some experience, you can quickly get started. In addition, Mint offers a web version, allowing users to manage their finances in more detail on their computers.

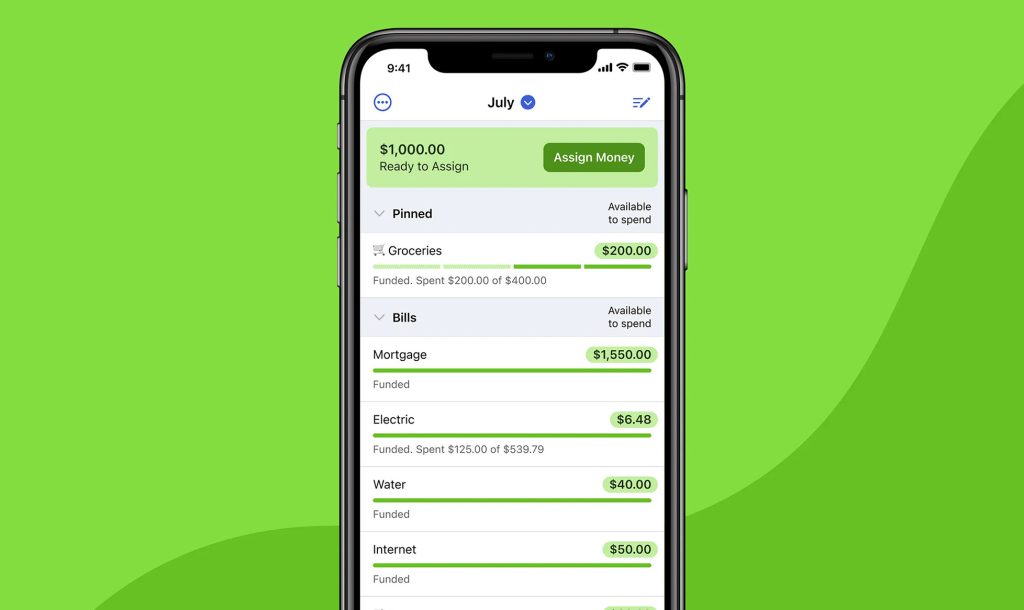

2. YNAB (You Need a Budget): The Expert in Budget Control

YNAB is an app dedicated to helping users create budgets and strictly control their spending. It emphasizes a zero-based budgeting approach, where every dollar of income is assigned to a specific expense category. This way, YNAB helps users avoid waste and ensures every penny is spent where it’s needed most.

Features

- Zero-Based Budgeting: YNAB requires users to allocate every dollar of income to a specific spending category, ensuring there is no “lost” money.

- Funds Rolling Over: If you don’t spend all the funds in a particular category during the month, YNAB automatically rolls over the remaining balance to the next month, helping you save money.

- Goal Setting: Users can set financial goals, such as savings targets or debt repayment goals, and YNAB will remind you of your progress toward those goals.

- Debt Management: If you have loans or credit card debt, YNAB helps you create a repayment plan and adjusts the amount based on your financial situation.

- Educational Resources: YNAB offers extensive financial management tutorials and courses to help users improve their financial knowledge and develop good money habits.

User Experience

YNAB’s interface is simple and intuitive, with clear functionality, making it easy to set up budgets and track spending. However, since YNAB operates on a subscription-based model, users need to decide whether they are willing to pay for such a comprehensive financial management tool.

3. PocketGuard: Easy Tracking, Automatic Saving

PocketGuard is an app that focuses on helping users control their spending and discover opportunities to save. It automatically calculates your “disposable income,” helping you understand how much you can freely spend each month, preventing overspending.

Features

- Disposable Income Calculation: PocketGuard automatically analyzes your bills, income, and savings goals to calculate how much disposable income you have each month, giving you clarity on how much money you can freely spend.

- Automatic Categorization: The app automatically categorizes your expenses and provides money-saving suggestions based on spending patterns. For example, if you’re spending a lot in a specific category, PocketGuard will suggest cutting back on those expenses.

- Budget Setting: You can set a monthly budget, and PocketGuard will alert you when you’re nearing the limit, helping prevent overspending.

- Bill Reminders: Similar to Mint, PocketGuard will remind you of upcoming bills, ensuring timely payments.

User Experience

PocketGuard’s interface is clean and easy to use. Its main advantage is the concept of “disposable income,” which helps users quickly understand their financial situation. For those looking for a simple and intuitive financial management tool, PocketGuard is an excellent choice.

4. GoodBudget: The Classic Envelope Budgeting Method

GoodBudget is a financial management app based on the classic “envelope budgeting” method. Traditionally, this method involves dividing money into physical envelopes for different spending categories. GoodBudget digitalizes this process, allowing users to create virtual envelopes for budget management.

Features

- Virtual Envelopes: Users can create multiple virtual envelopes based on their needs, each designated for a different expense category. For example, you could have an envelope for “food,” “entertainment,” “transportation,” etc.

- Budget Tracking: Every time you make a purchase, you can record the expense in the app, and the system will automatically deduct the amount from the corresponding envelope, giving you real-time visibility into how much of your budget remains.

- Synchronization: GoodBudget supports multi-device synchronization, so you can access and update your financial data on your phone, tablet, and computer.

- Debt Management: You can set up debt repayment plans in GoodBudget and manage them as one of your envelopes, helping you track your progress on paying off debt.

User Experience

GoodBudget’s interface is simple and easy to navigate. While it may not be as automated as Mint or YNAB, its “envelope” method provides a more hands-on and intuitive way to manage your budget. If you prefer to manually record and track expenses, this app is ideal for you.

5. Expensify: Focused on Travel and Expense Reporting

Expensify is an app mainly used for travel and expense reporting management. It helps users easily record travel expenses and generate reimbursement reports, making it extremely convenient for those who frequently travel for work or need to handle expense claims.

Features

- Receipt Scanning: Expensify can scan receipts by taking a photo and automatically extract details like amount, date, and merchant information, allowing for quick expense entry.

- Expense Categorization and Tagging: Users can categorize and tag each expense, such as “business trip,” “dining,” “transportation,” etc., making it easier to file expenses for reimbursement or auditing.

- Expense Reports: Expensify generates detailed reimbursement reports based on your expenses and supports exporting them in PDF or Excel formats for easy submission to your company or finance department.

- Multiple Account Support: Expensify allows users to manage both personal and business accounts, ensuring clarity and accuracy in financial records.

User Experience

Expensify’s receipt scanning feature is highly practical and reduces the time spent on manual entry. Its reimbursement functionality is also robust, especially for employees and frequent business travelers. However, for regular home users, Expensify might feel overly complex, as its features are more tailored to business travel and expense reporting.

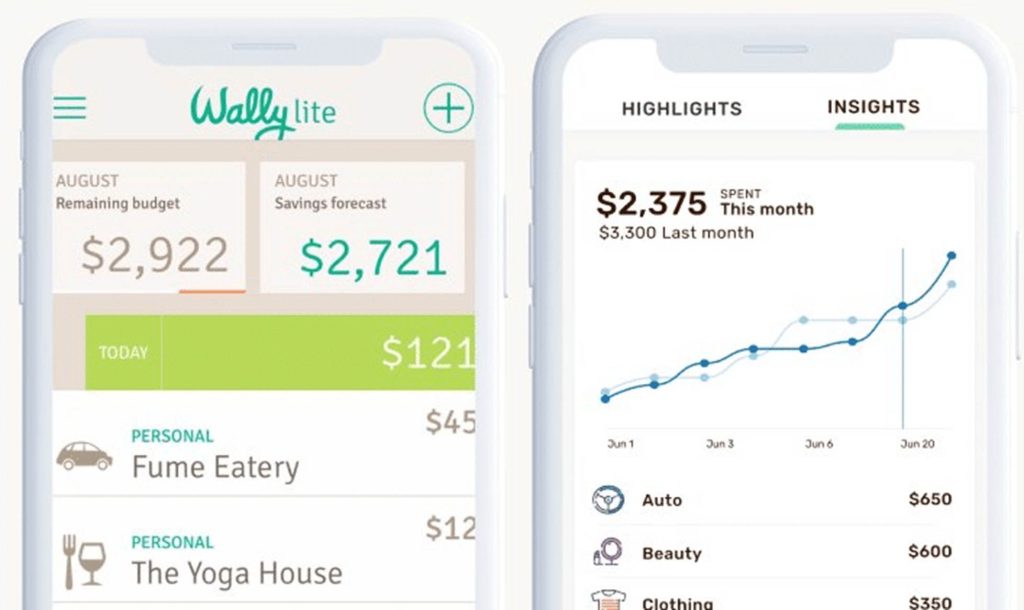

6. Wally: Precise Budget and Expense Tracking

Wally is an app suited for individuals and families, helping users track daily expenses and offering detailed financial analysis to assist in accurate budget planning.

Features

- Income and Expense Tracking: Wally allows users to manually or automatically track income and expenses, with detailed categories to help understand spending patterns.

- Budget Planning: Users can set budgets based on their income, and Wally will track whether spending is exceeding the budget, helping to maintain control.

- Financial Reports: Wally generates detailed financial reports, allowing users to review past spending and analyze their financial habits, optimizing future financial management.

- Multi-Currency Support: For international users, Wally supports multi-currency transactions, making it easier to manage finances across different countries.

User Experience

Wally’s interface is elegant and smooth, making the app easy to use. For users who need to meticulously track every expense, Wally is an extremely practical tool. The cloud synchronization feature ensures users can view and update their financial data anywhere, at any time.

7. Spendee: Elegant Design and Versatile Features

Spendee is a financial management app with a beautifully designed interface and powerful features. It uses charts and reports to help users visualize their financial situation, ideal for those who appreciate a visual approach to data analysis.

Features

- Graphical Analysis: Spendee displays your income, expenses, and budget through various charts (e.g., pie charts, bar graphs), providing an intuitive way to visualize your financial situation.

- Budget Management: Users can set budgets according to their needs, and Spendee will alert them when they’re nearing the limit, preventing overspending.

- Multi-Account Support: Spendee supports syncing multiple bank accounts, credit cards, and e-wallets, helping you manage all your finances in one place.

- Shared Accounts: Spendee allows for shared accounts, ideal for family members or partners who want to manage finances together.

User Experience

Spendee’s interface is visually appealing, and the user experience is smooth. It works well for individuals, families, or small teams who wish to manage finances collectively. For users who prefer managing finances with charts and data analysis, Spendee is an excellent option.

8. Personal Needs: Choosing the Right Tool for You

When choosing a financial tracking app, the most important factor is to select one that aligns with your personal needs. Different tools have different advantages and are suited for different user groups. Whether you want a comprehensive financial management tool, are focused on budget control, or prefer data analysis via charts, there’s an app that suits your preferences. By choosing the right tool, you can easily track your finances and cultivate good financial habits, ultimately achieving your goal of financial freedom.